One of the new measurements to prevent H1N1 is to stop shaking hands with your business counterparts, according to Taiwan government's latest advertisement.

And I wonder if one day I will tell my grandchild this: "You know, in my generation, we used to shake hands in business meetings."

And the grandchild screams: "No way, shake hands with someone you don't know? are you kidding me?"

2009年8月31日 星期一

2009年3月6日 星期五

Dow is now for good money

On March 5th, 2009, The Dow Jones Index is sitting at 6594.

Now I don't understand too much about money for value in the market, and I confess. But then nor do I think those analysts running up on day time tv (tvb or atv, I don't have cable so I don't get the mighty bloomberg or CNBC) really know that much either, after I spent about 2 weeks watching and listening to them daily (while I am not working).

But I dare to say this (and embarrasse myself if it comes to that), buy some Dow Jones index tracking fund now!

2009年2月27日 星期五

Taking note of the financial crisis

So now I realize the financial crisis is really making some ground.

My monther, who has retired and busy her time by learning English to kill time, surprised me one day by asking: "What is the Hang Seng Index?" and "What really is the Lehman Brothers?".

It shocked me because it is the first time she asked me something of the finance world. She probably has heard a lot about how financial institutions screwed the market, and naturually she wants to know who exactly are these 'brothers'?

Of course, with all I could, I tried my best to provide her with some answers. In particular, that, these Lehman Brothers were not exactly like a family of brothers, as its name would suggest. But then again, they were probably not that destinct from those harlem brothers who worked together for some bling bling. I mean, working 'exclusively' for the bling bling.

My monther, who has retired and busy her time by learning English to kill time, surprised me one day by asking: "What is the Hang Seng Index?" and "What really is the Lehman Brothers?".

It shocked me because it is the first time she asked me something of the finance world. She probably has heard a lot about how financial institutions screwed the market, and naturually she wants to know who exactly are these 'brothers'?

Of course, with all I could, I tried my best to provide her with some answers. In particular, that, these Lehman Brothers were not exactly like a family of brothers, as its name would suggest. But then again, they were probably not that destinct from those harlem brothers who worked together for some bling bling. I mean, working 'exclusively' for the bling bling.

2008年12月29日 星期一

What do a salesman, a prisoner, and an investor have in common?

So a few friends got into a debate over fed's influence on the interest rate - if it should be completely left at the hands of the market, ie, the central banks should not set a target rate and hence influence the market interest rate.

The opposite of my argument is that the market does a better job at setting an interest rate, one that will benefit the economy in the long term.

I thought the idea to not 'manage' the interest rate is a wild one. But it is nevertheless interesting to talk about.

Few of my relatives were visiting Hong Kong from the mainland, and as all HK visitors will do, they went to shop for electronics.

It took them a mere couple of hours to buy a digital camera, one that costed HKD $2300. However, luckily, or unlickly, they soon find out that the same camera was selling for HKD $1900 at another store of the same chain, only had they paid for it with cash. So the salesperson took advantage of them by withholding information of the cash discount.

My relatives were definitely not pleased. Fortunately, they managed to get a full refund, but you can bet they would be extra cautious next time they shop here in HK. On that day, the entire retail industry in HK took a hit at the doing of that greedy salesman, what tried to score higher commision by not disclosing the cash discount offer.

So what does this have to do with a pure market-based interest rate system?

It proves that it just won’t work. It is a classical Prisoner’s Dilemma problem. Each prisoner will confess because he thinks his counterpart will. That is, each individual will only try to maximize his local gain, resulting in a sub-optimal equilibrium of the system. See more on Prisoner's Delemma here - http://en.wikipedia.org/wiki/Prisoner's_dilemma.

As in retailing, every salesman will do what he could to maximize his commission pay, and that is often at the expense of the uninformed customers. But this hurts the industry, because customers will learn to compare prices from one store to another before the purchase (even stores of the same chain), and subsequently bringing down the average price (as the consumers become more informed, the market gets more competitive on pricing), and therefore margins for the industry.

In a pure market-based interest rate system, banks and investors will only look to ride the current market, make as much money as they can and try to get out just before everyone else does. They would argue that it is the other banks who should be more rational and responsible for the economy.

So in an overheated the market, the interest rate will only adjust, just right before a market crash.

The opposite of my argument is that the market does a better job at setting an interest rate, one that will benefit the economy in the long term.

I thought the idea to not 'manage' the interest rate is a wild one. But it is nevertheless interesting to talk about.

Few of my relatives were visiting Hong Kong from the mainland, and as all HK visitors will do, they went to shop for electronics.

It took them a mere couple of hours to buy a digital camera, one that costed HKD $2300. However, luckily, or unlickly, they soon find out that the same camera was selling for HKD $1900 at another store of the same chain, only had they paid for it with cash. So the salesperson took advantage of them by withholding information of the cash discount.

My relatives were definitely not pleased. Fortunately, they managed to get a full refund, but you can bet they would be extra cautious next time they shop here in HK. On that day, the entire retail industry in HK took a hit at the doing of that greedy salesman, what tried to score higher commision by not disclosing the cash discount offer.

So what does this have to do with a pure market-based interest rate system?

It proves that it just won’t work. It is a classical Prisoner’s Dilemma problem. Each prisoner will confess because he thinks his counterpart will. That is, each individual will only try to maximize his local gain, resulting in a sub-optimal equilibrium of the system. See more on Prisoner's Delemma here - http://en.wikipedia.org/wiki/Prisoner's_dilemma.

As in retailing, every salesman will do what he could to maximize his commission pay, and that is often at the expense of the uninformed customers. But this hurts the industry, because customers will learn to compare prices from one store to another before the purchase (even stores of the same chain), and subsequently bringing down the average price (as the consumers become more informed, the market gets more competitive on pricing), and therefore margins for the industry.

In a pure market-based interest rate system, banks and investors will only look to ride the current market, make as much money as they can and try to get out just before everyone else does. They would argue that it is the other banks who should be more rational and responsible for the economy.

So in an overheated the market, the interest rate will only adjust, just right before a market crash.

2008年12月15日 星期一

ATV - Family style

From SCMP’s City section, December 16, 2008, on ATV’s recent management turmoil, one employee of ATV (亞洲電視) commented:

“[ATV] has no culture, no goals and no communication. Everybody doesn’t know what others are doing but they are all burning money.”

Hm...I am guessing 90% of the family business in Hong Kong is operated as such.

The upside: I think there are tones of value to be unlocked in these companies given the right management, and the trust of the family shareholders in the management. But the question remains if the lot of family shareholders has the patient and will to sit back and watch changes unfold.

“[ATV] has no culture, no goals and no communication. Everybody doesn’t know what others are doing but they are all burning money.”

Hm...I am guessing 90% of the family business in Hong Kong is operated as such.

The upside: I think there are tones of value to be unlocked in these companies given the right management, and the trust of the family shareholders in the management. But the question remains if the lot of family shareholders has the patient and will to sit back and watch changes unfold.

2008年12月10日 星期三

What is different this time.

So there has been no short of news on the worsening financial crisis, and where and when it will bottom out. Many looked back as far as the great depression for comparison, and I am freaking out to think of the possibility.

One argument attributes to that the consumer confidents are hurt, so they will stop spending, to a point that will halt the entire economy.

But one thing people don’t seem to understand - the income generating force today is very much different than the ones in the great depression times.

When the great depression hit – around 1930, people were living in between two wars, WW1 ends around 1918 and WW2 starts around 1939. So households have very fresh memories of the difficult war time, and many would “save all” for preparation of another war. The difficulties of living people could endure back then is beyond our thoughts.

The working force is much different today. Most of us in our twenties to fourties have hardly gone through tough times. Especially if one grew up in the west to one of the developed countries. I can easily count a few high school friends who got their first car at age of 18 or earlier, myself included. We are to a bigger extend - spoiled!

Amid the current economy, those running a business will see sales drop; those who work will have a lesser sense of job security. But we will still spend a great level of money to be entertained. The new Keanue Reeves (the day earth stood still) movie might not be very good, but we will go watch it anyways...

There is no debate we are in a very bad crisis, but I think it is no where close to the great depression.

One argument attributes to that the consumer confidents are hurt, so they will stop spending, to a point that will halt the entire economy.

But one thing people don’t seem to understand - the income generating force today is very much different than the ones in the great depression times.

When the great depression hit – around 1930, people were living in between two wars, WW1 ends around 1918 and WW2 starts around 1939. So households have very fresh memories of the difficult war time, and many would “save all” for preparation of another war. The difficulties of living people could endure back then is beyond our thoughts.

The working force is much different today. Most of us in our twenties to fourties have hardly gone through tough times. Especially if one grew up in the west to one of the developed countries. I can easily count a few high school friends who got their first car at age of 18 or earlier, myself included. We are to a bigger extend - spoiled!

Amid the current economy, those running a business will see sales drop; those who work will have a lesser sense of job security. But we will still spend a great level of money to be entertained. The new Keanue Reeves (the day earth stood still) movie might not be very good, but we will go watch it anyways...

There is no debate we are in a very bad crisis, but I think it is no where close to the great depression.

2008年11月26日 星期三

If 24 was real.

WOW, the new 24 (24: Redemption) is really good!

And, the introduction of Madam President Taylor really got me thinking if it wasn't for Obama, we could have our first female president in Hilary Clinton. But at any rate, 24's crew already flashed its crystal ball in predicting a first black president with David Palmer.

So it has got me thinking, maybe the characters in 24 were inspired by real life politians. If so, here are the comparisons:

President Palmer

- David/Clinton wasn't perfect, but he will be loved by most.

President Wayne Palmer

- Wayne/Gore has great passion, but they always have to live in their big brothers' shadow.

Madam President Taylor

- Hey, they even wear the same suit, almost.

President Logan

- If you actually like Logan, you will love Bush.

Jack Bauer

- Maybe if the new 24 was aired earlier, McCain could have had a better chance winning the election.

And last but never the least...Kim Bauer

- Both John and Bauer did so much for them, but they never gave anything back.

Sorry, gotta end one with a Sarah Palin.

And, the introduction of Madam President Taylor really got me thinking if it wasn't for Obama, we could have our first female president in Hilary Clinton. But at any rate, 24's crew already flashed its crystal ball in predicting a first black president with David Palmer.

So it has got me thinking, maybe the characters in 24 were inspired by real life politians. If so, here are the comparisons:

President Palmer

|  |

- David/Clinton wasn't perfect, but he will be loved by most.

President Wayne Palmer

|  |

- Wayne/Gore has great passion, but they always have to live in their big brothers' shadow.

Madam President Taylor

|  |

- Hey, they even wear the same suit, almost.

President Logan

|  |

- If you actually like Logan, you will love Bush.

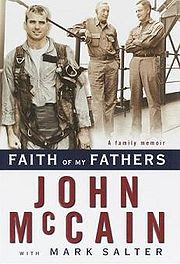

Jack Bauer

|  |

- Maybe if the new 24 was aired earlier, McCain could have had a better chance winning the election.

And last but never the least...Kim Bauer

|  |

- Both John and Bauer did so much for them, but they never gave anything back.

Sorry, gotta end one with a Sarah Palin.

訂閱:

意見 (Atom)