2008年12月29日 星期一

What do a salesman, a prisoner, and an investor have in common?

The opposite of my argument is that the market does a better job at setting an interest rate, one that will benefit the economy in the long term.

I thought the idea to not 'manage' the interest rate is a wild one. But it is nevertheless interesting to talk about.

Few of my relatives were visiting Hong Kong from the mainland, and as all HK visitors will do, they went to shop for electronics.

It took them a mere couple of hours to buy a digital camera, one that costed HKD $2300. However, luckily, or unlickly, they soon find out that the same camera was selling for HKD $1900 at another store of the same chain, only had they paid for it with cash. So the salesperson took advantage of them by withholding information of the cash discount.

My relatives were definitely not pleased. Fortunately, they managed to get a full refund, but you can bet they would be extra cautious next time they shop here in HK. On that day, the entire retail industry in HK took a hit at the doing of that greedy salesman, what tried to score higher commision by not disclosing the cash discount offer.

So what does this have to do with a pure market-based interest rate system?

It proves that it just won’t work. It is a classical Prisoner’s Dilemma problem. Each prisoner will confess because he thinks his counterpart will. That is, each individual will only try to maximize his local gain, resulting in a sub-optimal equilibrium of the system. See more on Prisoner's Delemma here - http://en.wikipedia.org/wiki/Prisoner's_dilemma.

As in retailing, every salesman will do what he could to maximize his commission pay, and that is often at the expense of the uninformed customers. But this hurts the industry, because customers will learn to compare prices from one store to another before the purchase (even stores of the same chain), and subsequently bringing down the average price (as the consumers become more informed, the market gets more competitive on pricing), and therefore margins for the industry.

In a pure market-based interest rate system, banks and investors will only look to ride the current market, make as much money as they can and try to get out just before everyone else does. They would argue that it is the other banks who should be more rational and responsible for the economy.

So in an overheated the market, the interest rate will only adjust, just right before a market crash.

2008年12月15日 星期一

ATV - Family style

“[ATV] has no culture, no goals and no communication. Everybody doesn’t know what others are doing but they are all burning money.”

Hm...I am guessing 90% of the family business in Hong Kong is operated as such.

The upside: I think there are tones of value to be unlocked in these companies given the right management, and the trust of the family shareholders in the management. But the question remains if the lot of family shareholders has the patient and will to sit back and watch changes unfold.

2008年12月10日 星期三

What is different this time.

One argument attributes to that the consumer confidents are hurt, so they will stop spending, to a point that will halt the entire economy.

But one thing people don’t seem to understand - the income generating force today is very much different than the ones in the great depression times.

When the great depression hit – around 1930, people were living in between two wars, WW1 ends around 1918 and WW2 starts around 1939. So households have very fresh memories of the difficult war time, and many would “save all” for preparation of another war. The difficulties of living people could endure back then is beyond our thoughts.

The working force is much different today. Most of us in our twenties to fourties have hardly gone through tough times. Especially if one grew up in the west to one of the developed countries. I can easily count a few high school friends who got their first car at age of 18 or earlier, myself included. We are to a bigger extend - spoiled!

Amid the current economy, those running a business will see sales drop; those who work will have a lesser sense of job security. But we will still spend a great level of money to be entertained. The new Keanue Reeves (the day earth stood still) movie might not be very good, but we will go watch it anyways...

There is no debate we are in a very bad crisis, but I think it is no where close to the great depression.

2008年11月26日 星期三

If 24 was real.

And, the introduction of Madam President Taylor really got me thinking if it wasn't for Obama, we could have our first female president in Hilary Clinton. But at any rate, 24's crew already flashed its crystal ball in predicting a first black president with David Palmer.

So it has got me thinking, maybe the characters in 24 were inspired by real life politians. If so, here are the comparisons:

President Palmer

|  |

- David/Clinton wasn't perfect, but he will be loved by most.

President Wayne Palmer

|  |

- Wayne/Gore has great passion, but they always have to live in their big brothers' shadow.

Madam President Taylor

|  |

- Hey, they even wear the same suit, almost.

President Logan

|  |

- If you actually like Logan, you will love Bush.

Jack Bauer

|  |

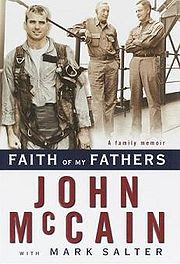

- Maybe if the new 24 was aired earlier, McCain could have had a better chance winning the election.

And last but never the least...Kim Bauer

|  |

- Both John and Bauer did so much for them, but they never gave anything back.

Sorry, gotta end one with a Sarah Palin.

U-Bankers

For one thing, its credit rating is tracking the wrong dude. The current system only tracks credit history of companies. Under this system, any average Joe can work the magic: creat a few companies and shuffle money around them – the goal is to make some of them credit-worthy at the expense of the other ones. Once you have built up a basket of beautiful apples, you have got your loancow (like cashcow of loans), and you may throw out (default) the bad lemons.

But the state banks are not stupid; they know this trick by heart too. Consequently, they don’t lend to your company unless they know you, or they know somebody who knows you. So hence a vague individual credit rating system. However, the network of who-knows-who does not help most of the smaller name, SMEs entrepreneurs, especially in the rural area where developments have lagged behind.

In turn, these SMEs entrepreneurs look to the savior - the informal underground banks (Check Here).

Some of these underground banks are actually more visible than you think. These U-Bankers often know the SMEs entrepreneurs well, both run business in the same industry and they likely have extended loans to the entrepreneurs in one form or another (think of a supplier-and-buyer relationship). Most importantly, U-Bankers have far better information on prospect customer’s ability to make payments.

As a case study, 奧康集團, a shoe maker from Wenzhou has set up a 1.5 billion loan company with state bank’s help and finance - 永嘉瑞豐 - (Check Here), and all of the 1.5 billion loans was ditched out three month after the company was set up.

I do not have a list of 瑞豐‘s customers. But I would bet those who borrowed from the pool of 1.5 billion were the shoe maker’s suppliers, business affiliates and the likes.

What is amazing is that I think a semi loan-bank like 瑞豐 will actually make a formidable profit. It charges a monthly interest rate of 10.2% to 23.1%, this is 122% annually! ((Check Here)) And, this is legal.

But, what if these loans are extremely risky therefore a loan shark-like interest rate is justified.

Sure, that could be the case, and I am no risk management expert. But, if my assumption was true, and that 瑞豐 only makes loans to those who it knows well and has credit information of, then the default risk could be mitigated somewhat. At the end of the day, 瑞豐 is operating with an on-paper yield of 122% and up, so they should have some appetite for risk.

So there you go, who would think some shoe maker out of a rural town in China has suddenly set foot in the high risk, high return venture capital funding business. Thanks to China’s out-dated banking system.

2008年11月12日 星期三

China is more Capital-centric...

So a few beloved friends of mine travelled to Hong Kong, as we met up for drinks, a ‘over-the-beer’ conversation centered on the form of “capitalism”.

One claimed: “On a scale of 1 to 100, China now resembles more capitalism than that of the U.S.”.

And, another friend concurred.

I couldn’t disagree more with what was said! But I didn’t know what arguments I could present to counter the claim. So it prompted me to look up Wikipedia for the definition of “Capitalism”.

“Capitalism is the economic system in which the means of production are controlled by the private sector rather than by government.”

Well, let’s see, on a relative basis, which government (China or U.S.) has more control over its nation’s production (think state-owned banks, oil/coal production companies, telecommunication companies and airline companies, etc.)?

While we have seen real estate development been privatized, which country, today, has more rigid control on its property rights and commodity prices (think no individual can own land in China but lease them, and the property price cooling measures Beijing has administered in the past twelve months)?

While the answer is obvious, I have to appreciate the topic of discussion. With the way China has transformed its centrally planned economy to a mixed one, how soon can we expect China to overtake the U.S. as the biggest economy, and when that happens, would it be as capital-based as the U.S.?

2008年11月4日 星期二

Here comes the Taskforce on economic challenges...

From SCMP, Nov 4th 2008:

"Being a small and open economy, the risk of Hong Kong going into a recession...It is expected that four sectors relating to financial services; trade and logistics; tourism and consumption-related services; and real estate and construction will be hit rather harder in the next year or so."

Yeah, thanks dude, why don't you just said every sector other than the IT industry will struggle? Oh, wait, there is not much IT industry in Hong Kong, so you can just say 'every industry will struggle'.

Thank you, and please send the cheque my way.

2008年9月30日 星期二

A lehman brothers deal

Don't peak yet, think.

The sentiment on property market in Hong Kong has turned, and property investors are eager to offload their investments. But how do you make your ads stand out from the crowd?

You call it a "lehman brothers deal". This branding strategy is cited from some creative sales ads in Hong Kong - see picture below. If that is not enough, we also have some 'financial crisis deal' to go along.

2008年9月29日 星期一

How did Mortgage-Backed Securities bring down the Investment Banks

I have tried to ask around, but none seem able to give me a satisfied answer. Articles from newspaper had always skipped on the mechanics, most of them offers nothing more than the old “investment banks have lost a lot of money from these MBSs, therefore they are in trouble”. But why are they in trouble if they have securitized these assets and sold them off?

After some research, I have come up with some hypothesis, and this is what I think: the investment banks buy mortgages from the mortgage underwriters, these mortgages are then pooled together before they are separated into various trenches. Each trend has a level of risk and coupon rate, much like senior debt versus junior debt, where senior debt is less risky but offers a lower yield. So the ibanks resell these mortgages of various trenches.

Now, ibanks retain some of these mortgages, and as it turned out, they retained the ones in the lower trench – the ones that are the riskiest but with highest yield.

In an up market (like 2006 and 2007), most of the MBSs performed and the lower trench MBSs were the most profitable, that is why ibanks earned some record profits in 2007. However, as the market begins its downturn, some of these mortgages defaulted, and the MBSs in the lower trench were the first one to hit. So follows the problems with the ibanks.

If you have another view, or that mine is simply off the mark, I will be happy to learn from you. But please remember to explain the mechanics in layman terms.

2008年9月28日 星期日

Spoiled Asian Flyers

Some passenger was also interviewed and he shared his experience with Cathay:

"...Others say that faltering cabin crew morale is having a divisive impact. 'On a good day, Cathay is still the best in the world', judges another frequent flier, 'but you can't be sure of a good day. I travel ecnomy because business is tooexpensive. On one outbound flight recently, I felt like royalty, the crew were superb. The inflight manager, whom I had never met before, talked to me at length even though the flight was full. All the crew greeted me by name, made sure I got Perrier with lemon, my meal choice, little things that don't cost anything except professional effort, wonder, Cathay is the best."

"On the return sector, it was the exact, dismal opposite. I was carrying some flowers. The inflight manager commented as I got on board, 'Nice; are they for me?' That was the last I saw of her"

"No one offered to put the flowers in the chiller, as good Cathay or a Japanese airline would have done automatically. The service was mediocre, and the crew spent time in the galley chatting about what to do on their layover..."

So as I read the 'bad' service this passenger saw on his return flight, I thought, hey, that is 'good service' on a Air Canada flight.

2008年9月18日 星期四

green bean and red bean

The link below is Ron's response when asked about Josh Howard's controversy - Josh Howard was filmed disrespecting the US national anthem. Mr. Artest's response, and you gotta like this, is "I think Josh Howard's comment is a reflection on education...".

http://sports.yahoo.com/nba/blog/ball_dont_lie/post/Ron-Artest-weighs-in-on-the-Josh-Howard-controv;_ylt=AkakI74v_mz1FVbGuyvkfhm8vLYF?urn=nba,108744

Reflection of education? And this is from Ron Artest? Are you kidding me? Is it the same reflection of education when Ron went in to the fans and started the biggest fans-versus-athletes brawl in NBA history on the night of 22 Nov 2004?

2008年9月16日 星期二

Management Profile

Ok, if you don't read Chinese, then let me translate (or the picture is just small, then I am sorry, so let me translate anyways). 在讀 means "working on", so 碩士在讀 means "working on a Master Degree". So simple counting has 4 of the 10 executives working on some Master Degree.

2008年8月27日 星期三

iphone girl

2008年8月11日 星期一

Olympic stuffed-animal

So I spotted a picture of them (see below) from Doug Smith's blog.

And now it shed some light on the source of the design...

No offence thought, I thought the opening ceremony was awsome!

2008年8月6日 星期三

Light in the office

So much for the who-gets-in-the-office-on-time game. Every morning I walk into the office, I have noticed one thing - the light is turned on in my boss’s office, but the door shut. My boss’s office is located towards the end of the hall way and behind some cubicles, so you can only see the door and light in the office from most angles (you can't see if anyone is in there though).

OK, I supposed my boss has beaten me to the office, since her office light is on every morning before I get in.

But well, I was tricked.

After some office investigation, I’ve found out it is the boss’s secretary who turns on the light in the morning, and she does it for exactly the reason I was tricked for. In fact, the boss actually keeps her door opened in the morning if she is in the office.

So the pattern works like this:

Light off + Door shut --> Boss not in

Light off + Door opened --> Boss not in

Light on + Door shut --> Boss not in

Light on + Door opened --> OK, she is there

So there goes the trap. But we all gotta appreciate the effort put forward by the secretary.

2008年6月5日 星期四

Patriot my butt

A new group of deputy ministers and assistants have been appointed in HK. Since these new group of public servants were also awarded with fat salaries - HK$130,000 per month for the lowest rank, they had stole some public and media attention.

One of which, is that some of these deputy ministers and assistants also hold passports of foreign countries like Canada, Britain, etc. So what? Well, "they are not patriots", some claimed. Therefore, they don't deserve high profile public jobs.

Consequently, these candidates resort to giving up their foreign residency rights and passports in hope of pleasing the general public. So they can keep the jobs.

Let's analyze the logic a bit here. If they were not patriots because of their foreign residency, then they don't qualified, period. Given up their foreign passports at this stage really doesn't change a thing. Patriotism cannot be bought, not publicly anyways. What these candidates really bought by giving up their passports was a fat-paid job, not patriotism!

And how does anyone not see this? Isn't it too obvious?

If I were the general public, I would fire the ones who gave up their passports before those who opt to keep theirs. Given both groups do not qualify as patriots, at least the later one showed some character.

2008年5月22日 星期四

Use me

So I have been wondering why? Why would she pull someone away from his desk - where he could potentially be more productive.

And I have just figured it out, the boss wants her associate there so, IF, there is follow-up work that falls on her plate, the associate is the one doing it.

But why can't she attend the the meeting herself and assign the task afterwards? Spare the associate from attending the meeting where he will likely not add a penny in the process. Because she doesn't want to explain the background information again. The logic is by attending the meeting the associate will somehow figure everything out himself.

So picture this, you are rushed into a meeting, knowing nothing of it, you sit through the meeting and don't say a word. Then one of the two things happens: meeting is dismissed and you have just wasted two hours of god knows what, or, you get a "ok, you know what to do right?".

I know I know, I really need to get used to the asian management style...

2008年5月20日 星期二

God bless

It would be "加油" (add oil), so "god bless America" is equivalent to Chinese people saying "中國加油" (China add oil).

Well, just a thought.

2008年5月12日 星期一

In the time of war, heros emerge

The champions of these fighters on the battle field are very much compared to an elite group of managers in a business negotiation. Managers need to gather information, hypothesize opponent's tactics, take a position, formuate a strategy and then execute it.

And no, it is not experience that matter the most in a negotiation. I would give priority to nutural instincts. It is how you read your opponent, what you do to get more information and use that information. You can get some training, but a great negotiator cannot be taught, but born.

But, there aren't that many great business negotiators in our time as there were great heros at the time of the Three Kingdom. As the consequence of failure is much less dramatic.

If you lose a battle at war, you will likely be killed and get killed when you return to your lord. In business negotiations, the end result is often much less obvious, you could screw up but report that you have done the best deal given the 'circumstance', and what the heck, you even demand a salary raise. And if you do flunk it really bad, you get fired but then you are out of the mess you created. So it ain't too bad and life goes on.

Still, I say we shall stay in business (as oppose to being in the army or a dentist, unless you are a dentist that is cute like a bear, just like my dear friend David). Wars today are different, they are all about 'team' and individualism is no longer praised, so being in business is as close as you will get in making a legend out of yourself.

But negotiation should serve another purpose to the great masters. Ancient emperors would reward and penalize their generals base on outcome of the battle field (think 300), a manager's ability can be very much 'read' in a negotiation. You can really see how one hypothesizes, communicates, bonds with the opponent and strategizes. All in a nutshell.

So, if you ever have to test one's talent, put him at 'war' and just watch.

2008年4月23日 星期三

Trust

North America starts a relationship by saying: "I want to trust you, until you prove it to me that I should not".

The HK way: "I don't trust you, but if you can, prove it that I am wrong."

For example. If you call in sick in North America, most of the time it requires only a phone call (that is why it is called "call-in-sick"). But in HK, you need to submit a doctor's note, else you don't get paid. (that is why we should call it "submit-a-doctors-note-and-prove-you-were-sick")

Yup, it feels like high school all over again in Hong Kong, doesn't it.

This is the fundamental difference in corporate culture between the west and the east. It is why managers in HK tend to micro-manage more, because you are just not trusted.

Raptors Playoff round 1 - Game 1 and 2

And I have officially joined the I-hate-TJ-Ford group. Watching him play at times reminded me of Kobe, only that he is missing all the skills that Kobe has. Not sure if we can trade him in the off season though, he is injury prone and all-about-me.

Can't wait to see what kind of magic Colangelo can pull together in the off season, we really don't have lots of trading chips. And not sure if trading Calderon and keeping Ford is something anyone should contemplate, it is a dumb idea, Jerry.

2008年4月10日 星期四

The title game

For entry level positions, you get the title of "non-officer", yeah, what the heck does that mean right? The best is yet to come: after non-officer, you are promoted to Associate Director, yes, you heard me right, Associate Director. After that, it is Director, then Executive Director, and finally Managing Director.

And you think, it is probably very hard to get out of the 'non-officer' rank, since the next rank is an Associate Director. Actually, not really. 60% of UBS employees have a Associate Director rank or better. For example, if you work for UBS's IT team, you could start as an entry level programmer, hence the rank of a "non-officer", then once you become lead programmer, you are an Associate Director, and so on.

So wouldn't you want to work for UBS (hopefully not at the non-officer rank) and pass out your business cards to friends and families? I mean, telling people you are an Associate Director for one of the world's most prestigious iBank is on par to telling your girlfriend you are a famous actor from a popular Hollywood movie. Well, almost on par.

Man, I wonder how such use of titles came to life? One thing for sure is it does inject some pride into the employees and hence lower HR turnovers for the company.

So if one day I start a company, I will start off everyone as a CEO, then Senior CEO, then Chairman and finally Big Daddy Chairman!

2008年4月5日 星期六

Fast Food Restaurant Menu

Woke up this morning around 8 - thanks to my jetlag, decided to do some good old Cafe De Coral for lunch. By the way, Cafe De Coral is my favourite fast food restaurant in HK, and I would rank Maxim second. I have always like Coral, not that because I use it too much since I live alone, but that it is well run, well managed.

As I approach towards the menu board, I started screening for something a bit more healthy and easy for an early stomach. The menu board is sitted next to the cashier counter, it is about 8 feets tall and 6 feets wide. It is separated into 4 columns.

It took me about 20 seconds to find something I want - fish with rice in corn sauce. It is somewhere in the 3rd column from the left, and in the bottom end of the menu board.

As I recall, the first few items under the 1st column are most oily dishes, and it sort of gets lighter as you move from 1st towards the 3rd one (the 4th column is for drinks). Now, suppose most customers screen for dishes in the same manner that I do - from left to right and top to bottom, that means I am not picking a very popular dish, otherwise they would have put it before the 3rd column.

Hm...so much for a healthy diet for Hongkongers. I wonder when the aktin's diet will start its root in HK, but it will be easy to tell when it does, we only need to look as far as the dish order on a Cafe De Coral menu.

2008年3月13日 星期四

Timing matters!

"I will have 2 pork burgers and 1 egg sandwich please" I said. (those pork burgers are actually snack size, therefore a sandwich to buffer my mighty stomach......hm......ok fine, I eat a lot).

"hm...", the secretary paused for a couple seconds and said "when are you going to eat that sandwich?"

Weird that she asked, I thought, "dunno, maybe after I finish the burgers, maybe a bit later in the afternoon if I get hungry..."

"ok, then you pay later, ok?" She responded.

erh....so what exactly was she saying? I wonder. Why would I have to pay? Meeting lunches are always expensed by the company. She was joking right?

So the meeting took place and I got my two burgers and a sandwich, just as I ordered. However, the day after, the secretary came into my office and showed me a bill of $18 for the sandwich.

Damn! She was serious! Since I told her I may not eat the sandwich at the same time with the burgers, then technically, the sandwich is not part of lunch, so it should be expensed out of my own pocket.

Wow, I mean, god, I am speechless!

Dilbert

So Dilbert's boss comes in and says to Dilbert: "I just had a senior management meeting, and the CEO wants us to push forward and get our projects completed!"

Dilbert responses: "Not a problem Sir, I will schedule a lot of meeting for next week!"

I actually came up with this one from experience. It is sad that some of the business today still operates at such capacity.

2008年3月7日 星期五

Standard Chartered Credit Card - Call Center

I called the Standard Chartered hotline to check on the status of my credit card application this morning, I spoke to the agent over the phone and she had problem locating my application file. So she asked me if it is a Manhanttan card that I applied for. "not sure" I said, but I got the number from Standard Chartered's website. She promised to go and check once more and kindly asked me to wait on the phone. But suddenly I realized I may have applied for the stand-alone Standard Chartered credit card, and not the Standard Chartered credit card in affiliation with Manhanttan card (Man, isn't banking product complex these days?). So instead of waiting for her to come back, I simply hang up.

Finally, I called the right number and got on the phone with the right people. As I was being serviced, my cell phone rang, and it was the lady I talked to from Manhanttan card services. She wanted to let me know she tried and still could not find my file. I cut her off (how rude) and told her it is ok coz I got the wrong number.

But, in restrospective, this is really caring service. A call center agent actually follows up on a service call even after a client drops the line, even that client called the wrong number.

Now, my imaginary girlfriend voice is saying: but that is what they are trained to do. Especially, if such call can potentially lead to a new client. So they are just doing their job.

True, I bet if I run a call center, this is one rule I would write into the agent's handbook - to follow up with the client if the line drops. But I would also write 50 other rules in their handbook, all equally important. There are just so many other protocals for call center agnets to follow.

But why have I never got such quality service back home in Canada? Did someone forget to write this rule? At times, a service call could even end up in some ugly exchange of words - yes, North American agents will piss back if they don't like you.

So what is the difference between running a service center in North American compare to one in Hong Kong? Cultural differences will probably top the list, but I think there is more than just that.

2008年3月4日 星期二

lunch at 1pm!

After a super busy morning trying to get some report done for senior management, I stoped by my manager's office just to let her know that if everything is ok, I would head for my lunch, but she can reach me on my cell shall there be an emergency. I thought this is totally in a sign of good faith, and I actually want to make sure she can go to the management meeting looking good (yeah, I actually meant it).

Well, what I get in response was: the corporate rule is that the lunch is to be taken between 1pm and 2pm, it was 12:24pm when I told her I would go for my lunch. So I shall not break the golden rule!

Hm, ok, let me see. I also remember on my employment contract, it says my office hour is 10am to 6pm. Although, from various time I work in the office long pass that 6pm exit rule. So I guess the corporate rule, at least in this part of the world, only works in one direction.

2008年2月27日 星期三

luxury apartment - hong kong style

So on a Sunday afternoon, we decided to check out the Grand Waterfront. The estate has five towers sitting adjacent to the old Kai Tak airport in east Kowloon. The estate is branded luxury, equiped a five star european style lobby and a fine club house featuring state of the art facilities including: a swiming pool, karaoke rooms, fitness center, a spa, a 20-seat cinema (the seats are actually full-size massage chairs) and more. Each tower has its own lobby and each lobby has two concierage person and a security guard. The concierage people actually deserve a word of attention as I find them being much younger (some of them in their twenties) than the average ones I have seen elsewhere.

Oh, and yes, did I mention you do not need keys for these flats? You unlock your door by putting your thumb on a scanning device on the door, or, keying in your password through a numberic keypad. Is this just cool or what? NASA style technology is being incorporated into our daily lives. And, you know, my buddy told me about this doorlock thing 3 times before coming to see the flats myself, and it is one of the few things I associated this estate with: the one you scan your thumb to open the door. Yet, I did not remember the name of the estate.

And onto the surroundings: east Kowloon is actually an old district, filled with public housing (public housing is quite common in HK) and an old airport pending for new development. So if you take a walk outside, you will see some aged buildings and dark streets; it will feel like you are in a forgotten part of the city. But, the thinking is that east Kowloon will be redeveloped in the next 5 to 10 years so its land value should rise. However, if you believe in market efficiency, the land price has already been priced in for the potential rise.

So if you wonder why I have not talked about the flats themselves, it is because I think they are the most interesting part. The agent showed us 3 flats, they are all 3-bedroom flats, but the smallest one is around 757 square feet. Yes, 757 square feet for a 3-bedroom flat. And what is more, one of the 757 square feet flats has 2 bathroom, one for the living room, and one for the master bedroom. Now, if you haven't seen a flat in this part of the world, let me tell you, the usable size of these flats are somewhere around 75%. So 757 times 75% gives you 567 square feet. If you don't have an idea of how big 567 square feet is, then you really have to come and see it in Hong Kong, it is smaaaaaaaaaaaaaaaaaaaaaaaaaall.

The smaller bedroom of the flat is probably the size of, hm, say an evalator. Although it is stretch side ways so you can actually fit a 6 feet by 2.5 feet bed. The room, nevertheless, has a window overlooking the sea, but the size of the window is so rediculously small that it reminds me of prison break. Actually, the ones in Fox River have bigger windows than this.

So how much does this thing cost you? Well, the asking price for the 757 square feet flat is HK$4.8 million. Which works out to be around US$630,000. Keep in mind, the usable are is 567 sqaure feet.

So is this bad? NO! there are way more rediculous flat prices in Hong Kong, especially on the island side (Hong Kong is devided into three big district: Hong Kong Island, Kowloon Peninsula, and New Territories). But what I found interesting is that, when you can't get space in a luxury flat, you are offered with a whole package of other things but space. You will get a nicely decorated club house (which is not very big either), a keyless door, Germany-imported home appliances, and a lot of people to greet you at the lobby.

2008年2月24日 星期日

intro

So here is a few sentence of background of what has led me to my current working life in Hong Kong:

Upon completing my undergrad in 2000, I have worked for various IT companies in Canada and the US. In the early days of the millennium, it was a very glamorous thing to work for a technology/dot-com company, in particular, software companies. I had worked with software developers who really took pride in their work and some 12 hours work day was an industry norm. I guess the same could still be said for guys at Google, well, my salute to the Google guys.

After some five years of seeing a relative fast changing IT industry, I have decided to take a different career path and moved on to completing a MBA degree at the University of Toronto. As fate would have it, I received and accepted an offer from a regional conglomerate in Hong Kong. W Holdings, became my first company after graduating from business school. Like my classmates, I had high hopes to what I could achieve in this company. Although, well, high hope is what most MBA program wants you to have, especially at a tuition of over fifty grand in two years.

So here is how I would describe my typical day in Hong Kong: I wake up at 8:30 (my official office hour is 10am to 6pm), eat my breakfast at home, or on my way to work at Tai Kai Lok (Cafe De Coral). Touch down on my desk at 10 sharp, read the news for 30-60 minutes, and start on cleaning up/replying emails. Although this routine can be scrapped if I have meetings scheduled or my boss wants something really quick. And in Hong Kong, people tend to schedule a lot of meetings and quite a lot of them are ad-hoc. My routine do get scrapped very often.

If things don't go out of wrack, I will have my lunch at 12 sharp. Yes, only 2 hours after my breakfast. This is because foodcourts in business districts get very busy between 12:30 and 2:00. So unless you don't mind waiting in line for 30 minutes (and my observation tells me a lot of HK people actually don't mind), you either have your lunch at 12, or after 2.

I would finish my lunch in about 20 minutes, and sometimes less. I developed this habit since coming to Hong Kong, and I am hoping that this could change once I find my regular lunch-mate. I would head back to the office and start my afternoon work. And again, what happens in the afternoon depends on if there are any meetings scheduled.

I will be blessed if there is a meeting-free afternoon and I can actually get some work done. It is not that I dislike meetings. On the contrary, I think meetings is where men are made. It is the best channel for communication and learning if all relevant people show up on time and are prepared for the subject of discussion. Unforturnately, this is not the case here.

From my 4 months of service, I can't recall one meeting that started with everyone show up on time; 90% of meetings don't have a meeting agenda and most of them are booked with no end time. This, has been the most frustrating part so far in my business encounterments.

Having worked in North America for the last five years, I have learned to respect other's time (although my girlfriend may disagree...), particularly in a business setting. I mean, how does a meeting become productive if there isn't a meeting plan to follow through? And most importantly, I want to look smart in these meetings, I really do...or, well, at least, not dumb. But I can't. I could only be prepared for these meetings if I was given some notice of their subjects in advance. But, I digress, maybe this is a key to sucess in Asia/Hong Kong, you either somehow figure it out or get kicked out. After all, there are westeners in these meetings too, who are educated and worked overseas (so I assume they had some different type of work ethics before coming to work in Hong Kong). So during the process, I assume they probably resisted, adjusted, and finally fitted-in (or gave up).